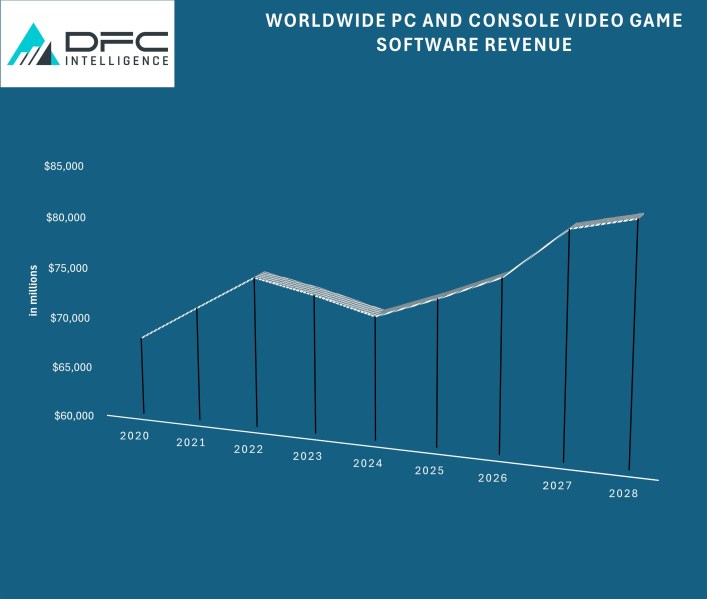

The video game industry, which is in the middle of one of its most difficult years in recent memory, is poised to return to growth in 2025, according to DFC Intelligence. The game analyst firm makes this claim in the preview of its annual market report, which releases in full in December. According to DFC’s findings, the video games industry will return to growth in 2025, and in fact next year will be the beginning of a record period of growth.

DFC predicts that gaming will surpass the record highs set during the COVID-19 pandemic following the last two years of decline. It also predicts that consumers will continue to spend a lot on hardware, including consoles, PC and accessories — including whatever new consoles the major manufacturers put out in the next few years. Out of all those consoles, DFC predicts Nintendo will win the race for sales.

GamesBeat asked DFC founder David Cole about some of the report’s findings, including the reasons behind the current lack of growth. According to him, the video game industry has been steadily growing since the ’70s and ’80s, with each generation of gamers advocating the medium to the next. He called the pandemic-era growth, “an artificial and temporary spike in demand, accompanied by disruption in the supply chain for both hardware and software” followed by a “natural correction.”

Cole added, “We see overall industry growth but as always the biggest problem is companies expecting too much growth and/or over investing in the latest fad. A big issue this generation has been a disruption for the latest PlayStation and Xbox generation. I think the focus was put on getting manufacturing up to speed versus marketing the latest generation of video game consoles to that secondary user base that helps drive sales in later years. That has had a negative ripple effect that we

believe was a unique occurrence due to the Covid situation.”

Other findings in DFC’s 2024 report

The report’s findings are not entirely positive — regarding the consoles, DFC predicts that only two out of three will see “meaningful market penetration,” and Cole compared the prospects of the third-place finisher to the dismal performance of the Wii U. DFC also predicts a battle to control distribution in the industry, with a corresponding increase in marketing and community relations.

One other thing to note is that DFC’s report also predicts that new tools, including AI, will make it easier for developers to create bigger and more complex games with smaller teams and budgets. Since the firms expects add-on content (expansions, cosmetics, etc.) revenue to exceed that of full games, larger studios may focus on live-service content and established franchises — leaving the market open for smaller studios to launch original IP.

When GamesBeat asked how the games industry can avoid a repeat of the disastrous last two years, Cole said, “Unfortunately, an event like Covid can throw a monkey wrench into all plans. The hope is that the smart money in the industry has learned some lessons. Video games are considered a “sexy” business that many people desire to get into. The result can be a lot of money being thrown around without careful consideration.

“The next few years is going to see a major hardware transition with new consoles, continued emergence of cross-platform PC gameplay and multiple monetization models. Even with growth it will not be an easy period to navigate. Like other entertainment areas there tends to be an oversupply of products, and you will always have a lot of losers. That is just the way things roll.”

[ad_2]

[ad_2]